Europe’s infrastructure investments are not growing fast enough to reach net zero

On 25.04.2023 by Lena KlaaßenBy Lena Klaaßen

Lena is a PhD candidate with the Climate Finance and Policy Group at ETH Zurich as part of the GREENFIN project on effective green financial policies for the low-carbon transition. Her research focuses on the role of the financial sector in accelerating investment in low-carbon technologies. She is specifically involved in investigating technological changes and their future investment needs for a Paris-compatible pathway.

Massive investment in low-carbon infrastructure is required to put Europe on a path to net zero by 2050. While this is no big surprise, it is astonishing that investments are still growing rather slowly, even for market-ready technologies such as onshore wind or solar PV. This blogpost quantifies current investment gaps in Europe’s energy infrastructure and discusses the hurdles that must be urgently overcome to reach the required investment levels.

To reach net zero by 2050, Europe requires significant investments in low-carbon infrastructure. A major portion of this investment is needed for energy-related infrastructure, including renewable power plants as well as electricity grids and storage. Despite increased political efforts to redirect investments into these key areas, investments are not growing fast enough. To overcome the prevailing multi-billion dollar investment gaps, I argue that there is a strong need to ensure that local policies do not undermine national policies and that approval processes for new investment projects are streamlined and accelerated.

Infrastructure investments need to rise substantially in the very near term

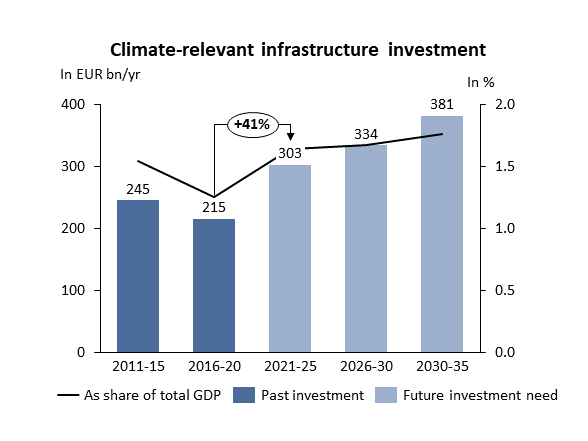

In a recently published meta-analysis on investment needs in Europe, we found that a substantial increase in infrastructure investment of almost EUR 90 billion per year (bn/yr) is required in the very near future (2021-2025) to achieve net-zero pathways. This is an uptick of 41% compared to the past investment level of EUR 215 bn/yr from 2016 to 2020. The total investment requirement for climate-relevant infrastructure thus amounts to EUR 300-350 bn/yr until the end of this decade. It may seem ambitious but is feasible to achieve with less than 2% of total GDP in Europe – which largely corresponds to the investment shares to date (Figure 1). However, infrastructure investments have declined over the last decade and thus there is now a need for a steep and quick uptick in investment.

Figure 1. Past investments and future investment needs in Europe. Europe is defined here as EU-27 plus Norway, the United Kingdom, and Switzerland. Own graphic based on Klaassen and Steffen (2023).

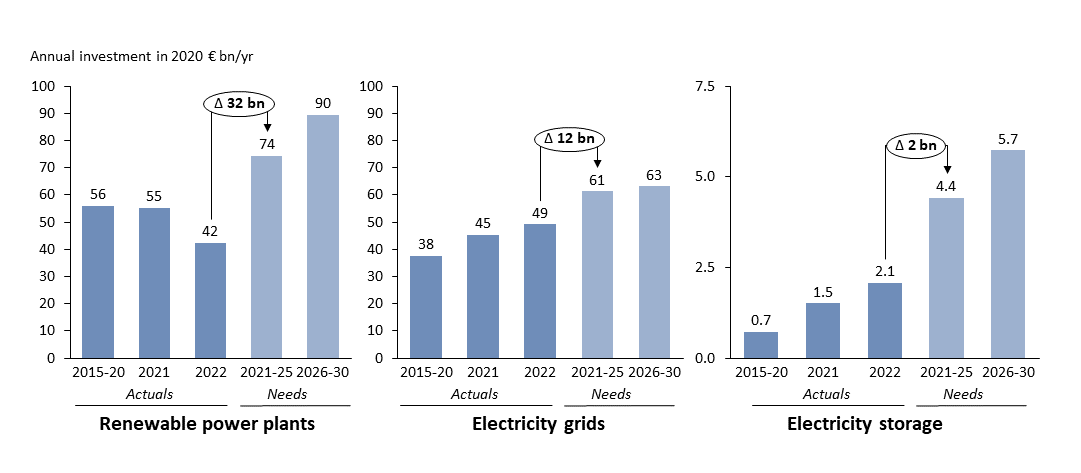

So far, a multi-billion euros investment gap prevails in all key areas

Looking at the most recent investment data for renewable power plants, electricity grids and electricity storage for 2021 and 2022 (Figure 2), it is clear that the required level of investment is not being achieved in any of the key areas. For all key areas the actual investments in 2022 remain below the average annual investment needs for 2021-25, resulting in investment gaps of 32 bn/yr, 12 bn/yr, and 2 bn/yr for renewable power plants, electricity grids, and electricity storage, respectively. Even more worrisome: Investments in renewable power plants have significantly dropped in 2022 compared to the previous years. This drop is due to a sharp decline in wind offshore investmentwhich had previously led to investment growth in preceding years, whereas wind onshore and solar investments in Europe remained stagnant in the past year. For electricity grids and storage the trend looks slightly more positive with steadily rising investment numbers in 2021 and 2022. Consequently, both are experiencing remarkable upward momentum which, if sustained, could result in the required level of investment being reached within only a few years. For battery storage, the trend seems particularly promising as it is even more pronounced in other markets (e.g. China and the U.S.) where battery storage investments have roughly doubled from 2021 to 2022, demonstrating that fast growth rates are possible. However, overall, it needs to be clearly contested that as of today, there is a multi-billion euros investment gap in all three key areas, putting the net zero target in danger.

To close the investment gap, regulatory and practical hurdles must be overcome as soon as possible

Regulatory and practical hurdles are an essential factor that investments in low-carbon technologies are not growing fast enough or are stagnating, as is the case for solar and wind power plants. The existing hurdles are manifold and multifaceted. However, there are two that stand out in particular as they come up very frequently and have already caused significant delays and have the potential to cause even more. These are also particularly relevant for the expansion of renewable power plants, especially wind power, which has stagnated over the recent years.

- Lack of harmonization of national and local policies:

National policies that support the quick expansion of low-carbon technologies are indispensable but may prove inefficient if being undermined by local laws. One striking example are local distance rules for wind turbines in the South of Germany which led to an almost non-existent wind power expansion in Bavaria and Baden-Würtembergdespite accounting for almost one third of the German area. This case shows how a lack of harmonization of national and local policies can significantly impede investment flows into low-carbon technology projects, which is particularly likely in federally organized states, such as Switzerland or Germany. This February, a new German law came into force that now requires local authorities to designate a certain area for wind power plants. If they fail to do so, their local distance rules cease to apply in order to ensure that the expansion is not impaired.

- Lack of streamlined approval processes

One of the main reasons for the stagnating expansion is the excessively long approval procedures, in particular for wind power plants. Without streamlining approval processes and putting more pressure on authorities, it will be difficult to achieve the required speed to reach the levels of investment needs identified. To accelerate the process, time limits for process steps, which if not met lead to an automatic approval of the project (as for instance suggested by the German think tank Stiftung Klimaneutralität), would incentivize concerned authorities to inform project applicants promptly about missing documents, align more efficiently internally and speed up the decision process, which ultimately boosts investments.

The time to close the investment gap is running but the goal is not out of reach

From the presented findings it becomes clear that current investment levels are lagging behind and multi-billion euros investment gaps prevail in all key areas. However, the numbers show that required investment levels are not out of reach. Indeed, we already see positive developments in the most recent investment patterns for some areas. If the regulatory and practical hurdles are quickly overcome, there is a high chance that investments in Europe’s climate-relevant infrastructure will experience a substantial boost providing a positive sign for other investors. However, if the current trajectory is continued, it will get near to impossible to reach net zero pathways without significant delays.

Lena Klaassen received funding from the EU Horizon 2020 research and innovation programme, European Research Council (grant agreement no. 948220, project no. GREENFIN) for this project.

Cover image : Photo from Adobe Stock (via ETH Zurich access)

Keep up with the Energy Blog @ ETH Zurich on Twitter @eth_energy_blog.

Suggested citation: Klaassen, Lena. “Europe’s infrastructure investments are not growing fast enough to reach net zero”, Energy Blog @ ETH Zurich, ETH Zurich, April 24, 2023, https://blogt.ethz.ch/energy/europe-infrastructure-investment

If you are part of ETH Zurich, we invite you to contribute with your findings and your opinions to make this space a dynamic and relevant outlet for energy insights and debates. Find out how you can contribute and contact the editorial team here to pitch an article idea!