Making gas network regulation fit for decarbonization

On 22.04.2022 by Paul WaidelichBy Paul Waidelich

Paul Waidelich is a doctoral researcher at ETH Zurich’s Climate Finance and Policy Group where he is investigating policy instruments to mobilize private sector investment in low-carbon technologies, the economic impacts of climate change and the regulation of energy networks. Prior to joining ETH, Paul worked at NERA Economic Consulting advising energy companies, regulators and financial investors on electricity, natural gas, and hydrogen markets. His academic publications have appeared in Environmental Research Letters, Energy Policy, and more.

To meet our global climate targets, the use of gas distribution networks will likely decline over the coming decades in Europe. Current gas price hikes and shifts away from Russian supplies will accelerate this transition. Under current regulation, however, lower network usage leads to increasing network tariffs, and to customers paying for potentially redundant infrastructure. Therefore, we need an honest debate about the future of gas networks, and who will carry the costs if pipelines are decommissioned prematurely.

Use of gas distribution grids will likely decline substantially

To reach net-zero, the role of natural gas as an energy carrier in Europe must decrease considerably over the coming decades. Recent gas price rallies and the EU’s new ambition to reduce Russian imports will only exacerbate this development. For gas networks, this means a substantially lower usage of existing infrastructure. In the case of the larger, cross-regional transmission networks, this development might be mitigated by retrofitting networks to hydrogen, and building new gas power plants as a bridge technology. However, this way out is limited for smaller and meshed distribution grids, which primarily deliver natural gas for heating buildings. In the medium term, the green hydrogen and biogas supplies for heating buildings will be limited because domestic potentials are insufficient and for hydrogen, potential export countries face high financing costs and currently lack the required infrastructure. Therefore, the available green gases must be used for processes where decarbonization alternatives are still not available, e.g. in refineries or the chemical industry. In contrast, heating buildings can be decarbonized via heat pumps and district heating, which are often cheaper as well. As a result, the official exit strategy of gas distribution networks, namely switching to 100% green gases, will not warrant the current size of distribution networks – which in Switzerland alone have a value of almost CHF 5bn.

Lower demand increases network tariffs and poses stranding risks

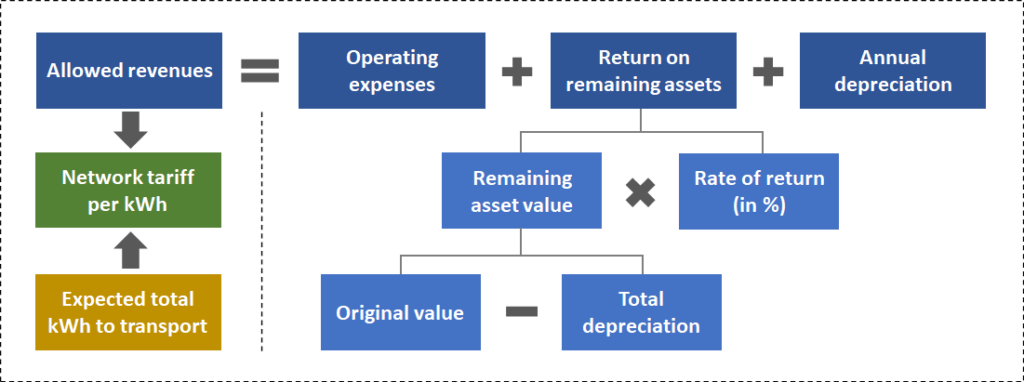

In a competitive market, a declining network demand would lead to reduced network tariffs. However, gas distribution networks are monopolies and hence subject to strict regulation in virtually all European countries. Regulatory agencies therefore determine how much network operators can earn for their services. Simply put, regulation allows operators to cover their network costs, i.e. operating expenditures and annual depreciation, and earn a pre-defined return on the remaining asset value (see Figure 1). If demand drops, the allowed revenues remain the same such that the network tariff per transported unit of gas increases. This directly raises end-user gas prices of which network tariffs account for about a quarter in Germany and Switzerland. In extreme cases, a network-wide demand collapse leads to a so-called “death spiral” where higher network tariffs reduce demand even further. Furthermore, demand reductions can render some network assets redundant, particularly if overly optimistic expectations led to unwarranted investments in the past. This poses the question if and how such “stranded” assets should still be recouped via network tariffs, and how a regulatory framework that was designed for constant or growing demand can be made fit for the challenges ahead.

Figure 1: How regulated gas network tariffs are determined (source: own visualization. Note that this representation is strongly simplified and omits several relevant elements, e.g. regulatory benchmarking.)

Who should pay? It’s complicated

The predictable decline of distribution grid usage poses a challenge for European energy regulators: On the one hand, they must avoid future tariff hikes that can cause economic disruption and hurt poorer households disproportionately, who usually are “captive” tenants with no control over their heating source. Therefore, making end-users pay for stranded assets raises important fairness concerns. On the other hand, regulated network operators expected a reasonable return at the time of their investment decisions. Denying them amortization in hindsight could be seen as opportunistic and decrease the credibility of network regulation, with negative implications for electricity and hydrogen grid investments. The fact that many distribution grids are operated by publicly owned municipal utilities makes matters even more complicated because losses of these companies would ultimately be borne by the public sector.

A variety of options on the table, but most countries still to act

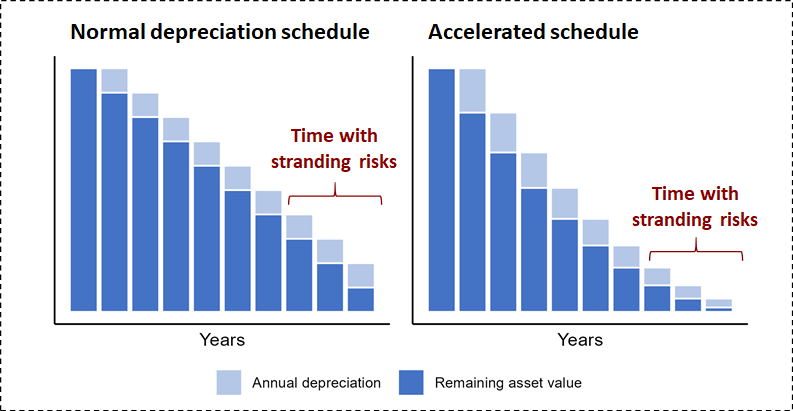

Regulators should therefore consider measures that neither guarantee network operators full cost recovery nor deny them any kind of protection against stranding at all. Some jurisdictions have already opted to accelerate the depreciation schedule (e.g., in the UK, Belgium, Austria and the Netherlands) as illustrated in Figure 2. This increases current network tariffs to decrease the risk that assets must be decommissioned before they are fully recouped. It also reduces the cost burden on future network users, who are more likely to be captive since more affluent homeowners switch to other heat sources and leave the grid. However, even if depreciation accelerates, assets might still strand. Therefore, some regulators have offered upfront provisions, e.g. via a higher regulatory rate of return (in France, New Zealand, and Austria), or allowed the write-offs for decommissioned assets into allowed network costs (in the Netherlands). While the latter provides little incentive to scrutinize potential new investments and places all costs on customers, a higher rate of return easily fits into current regulatory frameworks and could be combined with earmarking the resulting extra revenues to cover the costs of write-offs. To alleviate the cost burden of tariff increases on low-income households, compensating measures such as lowering tax rates on electricity or targeted support payments should be considered. Certainly, the most suitable measure will vary across jurisdictions due to different network and legal structures as well as decarbonization pathways. For most jurisdictions, including Germany and Switzerland, however, it is still unclear how regulators intend to deal with future demand declines.

Figure 1: Accelerating depreciation reduces exposure to asset stranding (source: own visualization. Note that this chart assumes that the normal depreciation schedule is linear, which is the case for many but not for all jurisdictions. The accelerated schedule displayed here follows a sum-of-the-years’ digits approach.)

Regulators should move as soon as possible

Therefore, we urgently need an honest debate about the looming demand risks for gas distribution grids. Regulators should assess these risks and initiate consultation processes on potential measures to address them. This allows all relevant stakeholders to settle on ways forward for network regulation in times of declining demand. In contrast, postponing this debate limits the regulatory room for maneuver in the future while increasing stranding risks through ongoing investments. For many countries, accelerating or flexibilizing depreciation schedules would be a simple step in the right direction and can be easily implemented in their regulatory frameworks. If jurisdictions decide to further protect gas network operators (partially) against asset stranding, this must also involve a critical evaluation of investment plans as well as establishing clear procedures for decommissioning decisions. Energy researchers can guide this process by expanding the relatively small literature on regulatory stranding in gas networks, estimating demand and tariff scenarios, and modeling the impacts of the different regulatory measures available.

Cover photo by fotowunsch/AdobeStock

Keep up with the Energy Blog @ ETH Zurich on Twitter @eth_energy_blog.

Suggested citation: Waidelich, Paul. “Making gas network regulation fit for decarbonization”, Energy Blog @ ETH Zurich, ETH Zurich, April 22, 2022, https://blogt.ethz.ch/energy/gas-network-regulation/

If you are part of ETH Zurich, we invite you to contribute with your findings and your opinions to make this space a dynamic and relevant outlet for energy insights and debates. Find out how you can contribute and contact the editorial team here to pitch an article idea!