Energy systems and insurance: a primer

On 12.12.2023 by Kate LonerganBy Kate Lonergan

Kate is a PhD student in the Department of Mechanical and Process Engineering. She is also an editor with the Energy Blog @ ETH Zurich.

Insurance services help individuals, businesses, and organisations be more resilient and recover from financial losses. But what role does insurance have in the energy sector? Find out below with some key takeaways from our recent publication Ensuring/insuring resilient energy system infrastructure in Environment Systems and Decisions.

Who is paying for energy systems recovery?

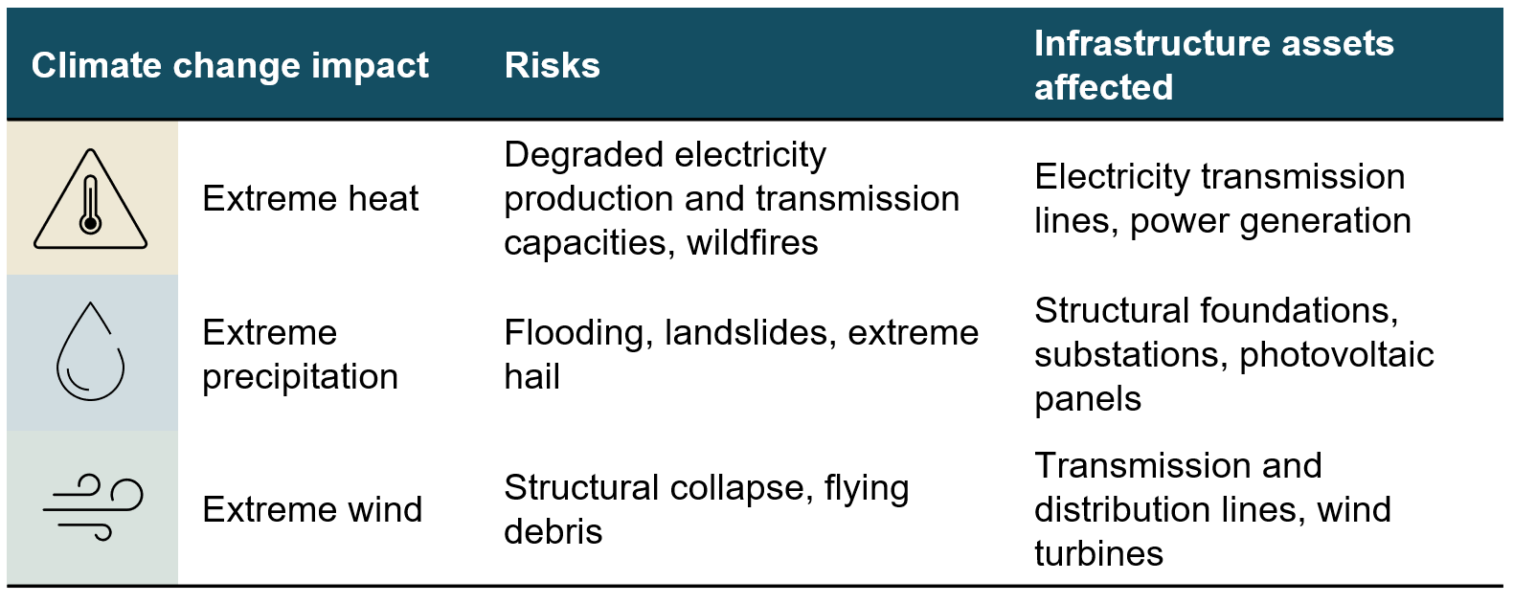

Functional energy systems are essential to modern society, providing services like lighting and supporting the proper functioning of other systems like water, transportation, and telecommunication. Despite the fact that energy delivery is highly reliable in many parts of the world, the energy infrastructure remains vulnerable to extreme weather events. Extreme heat, precipitation, and wind all pose threats to energy generation and transmission infrastructure – threats that are set to increase due to a changing climate (Figure 1). Protecting infrastructure against every potential risk is not a realistic path forward, but disruptions to energy delivery can be minimised by helping the system recover as soon as possible following an outage. However, getting an energy system back up and running requires more than solving technical problems: it also involves figuring out how to pay for repairs.

Figure 1: Risks of extreme weather events and climate change on physical energy infrastructure. Risks summarised from International Energy Agency (2021)

Three types of actors can be involved in paying for energy systems recovery following an outage: infrastructure asset owners, public actors, and private insurance companies. Infrastructure asset owners often pay for repairs themselves as maintenance is part of day-to-day business operations. In some markets, asset owners also help each other out through mutual insurance pools like AEGIS, which is available for North American gas and electricity utilities.

Other potential sponsors for infrastructure repairs are public actors such as governments and public programmes, who are often willing to pay for repairs since a functioning energy system is in the wider public interest. Public actors are especially relevant following disaster situations, where other energy sector actors might have insufficient financial might to quickly pay the upfront costs required for infrastructure repairs.

A third type of actor who could help pay for recovery costs are private insurers. Private insurance has historically helped manage risks associated with unlucky outcomes in other sectors (e.g., health insurance, auto insurance, travel insurance) in most “developed” economies. As such, governments (including from the European Union and the United States of America) are hoping that private insurers can increase their offers to help manage infrastructure risks, too, especially as the financial risks associated with extreme weather events continue to increase. In addition to their experience developing strategies to minimise losses, private insurers have extensive data repositories about all types of loss events that could be useful in developing novel insurance policies for energy infrastructure.

Insurance for recovering from extreme weather events

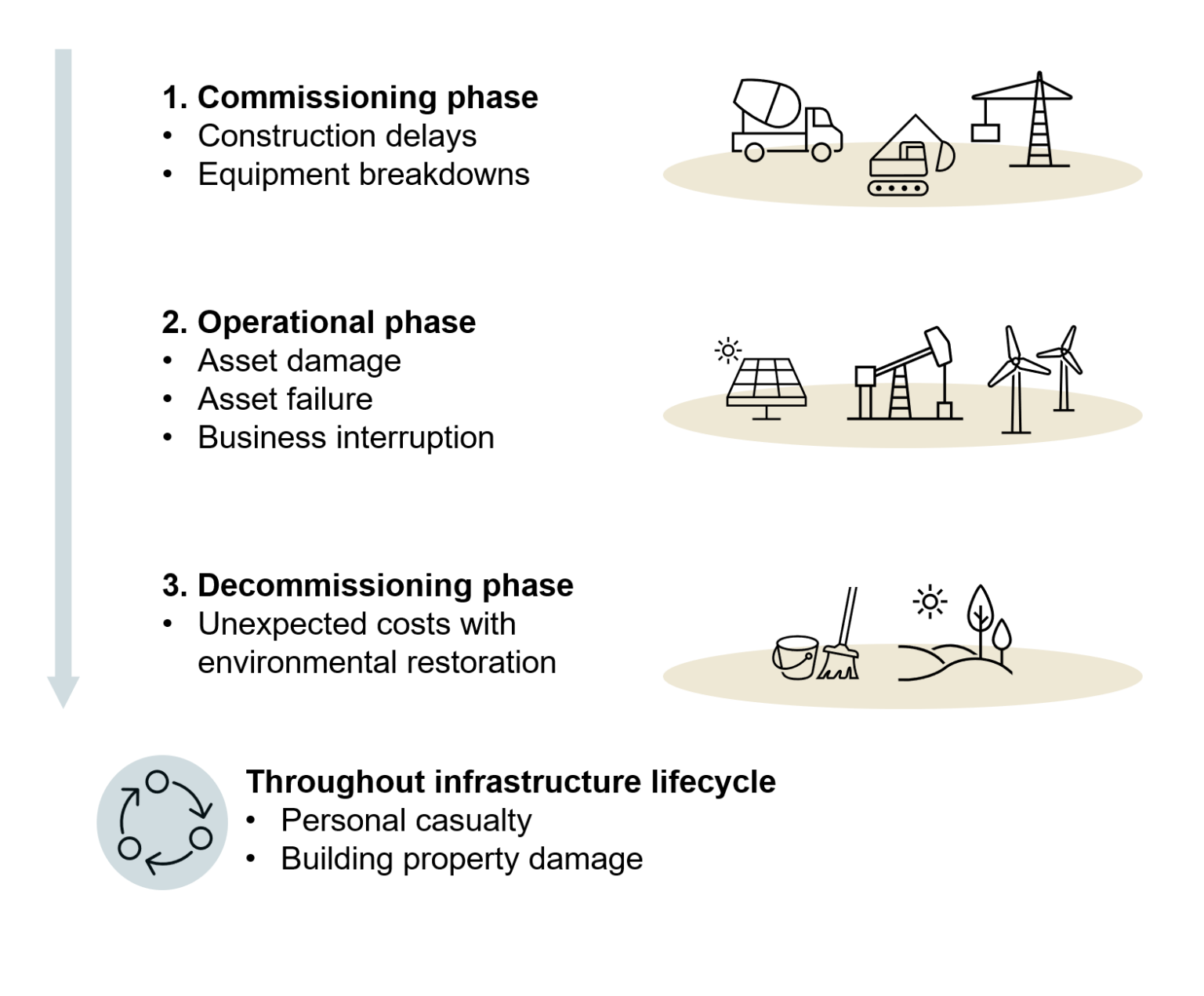

Insurance can be used to support energy systems throughout the infrastructure lifecycle (Figure 2), including the commissioning, operational, and decommissioning phases. In practice, however, insurance is not widely used in the operational phase to help system recovery following extreme weather events. There are at least three reasons why.

First, private insurers may have little appetite to take on the large costs associated with repairing energy infrastructure after catastrophic events. Energy infrastructure is expensive: single transformers can cost millions of Euros while overhead electricity can cost millions of Euros per kilometre. Insurers already help consumers recover from severe weather events through policies like property insurance (The value of insured losses for storm Bernd in Western Europe in 2021, for example, is in the range of billions of Euros). Increasing the scope of insurance policies is understandably not immediately appealing, especially for high-cost infrastructure systems such as energy.

Second, calculating the appropriate cost for insurance policies is not straightforward. The cost of insurance policies is determined probabilistically, which requires extensive datasets of past occurrences. So, while the rarity of catastrophic energy systems failure is good news for consumers, it also inhibits the development of insurance policies. Moreover, climate change is altering the frequency and intensity of extreme weather events, further negatively affecting the predictability needed to develop insurance products. Finally, even when the insurance policies can be set via other methods, the policies may be too costly and restrictive for potential customers.

When private insurance is provided for recovering from extreme weather events, it is usually for finite locations where risks can be clearly defined, like office buildings and single generation units. This situation leaves large sections of energy systems uninsured against disaster events, such as thousands of kilometres of high voltage transmission lines. Particularly vulnerable are lower-income countries, where catastrophe insurance is less common and extreme weather impacts can have more intense impacts than in higher-income settings. Ensuring a quick recovery for the global energy systems therefore requires expanding existing financial recovery strategies to a wider range of assets and geographies.

Figure 1: Potentially insurable risks throughout the energy infrastructure lifecycle.

Ways forward

Getting private insurers to be more active in disaster recovery requires either obliging insurance companies to offer coverage or helping them develop business cases that allow insurers to stay profitable while keeping customers interested. Three things would help:

First, modifying the structure of insurance products applied for extreme situations would help insurers better manage financial risk and could attract a new pool of clients. Typical insurance policies are structured based on losses: costs are paid out according to the value of the damage incurred. An alternative form is parametric insurance, whereby insurers transfer funds based on the potential cause of damage. With parametric insurance policies, insurers transfer a predetermined financial sum (a “payout”) to their clients upon the occurrence of a “triggering event”; for example, a triggering event could be an area-averaged wind speed or a certain amount of precipitation within a 24-hour period. Notably, the value of the payout is agreed upon contract signing and does not depend upon the cost of the actual damages; this helps insurers manage financial risks. In addition, because potential costs are established beforehand and there is no need to conduct a detailed loss assessment, which can make policies more affordable for potential new clients. On the other hand, the payout may or may not be sufficient to cover the entire cost of damages. For some clients, this partial support may still be preferential to not having any insurance at all. Parametric insurance has already been shown to be attractive in other previously hard-to-insure contexts, like agriculture, paving the way for potential energy-focused products.

Secondly, integrated modelling tools could help price insurance policies. Current models often feature a significant bias by relying heavily on historical climate data; updating models to better reflect changing environmental conditions would help insurers stay profitable. Future modelling directions include integrating climate, weather, and technical infrastructure resilience models to better understand the relationships between a changing natural environment and threats faced by specific pieces of energy infrastructure.

Finally, private insurers should work with clients and governments to identify opportunities.

Recovering from extreme weather situations will likely remain a joint responsibility between private and public actors; governments and clients can support private insurers by identifying situations that they would struggle to carry without additional support. Working with clients is also key to developing insurance products that build on existing offers and ensure that the offers are commercially attractive. Ultimately, insurers are private businesses who care about their financial bottom lines, so doing business in the energy sector must be profitable to keep them interested.

These recommendations are easier said than done; however, all three offer concrete steps forward. To find out more about insurance in the energy sector and more details about each of the pathways forward, we invite you to read the full publication and learn more parametric insurance through the insurers themselves (e.g., via Swiss Re, Munich Re, Allianz, or AXA)

Cover image : K.Lonergan (2023)

Keep up with the Energy Blog @ ETH Zurich on Twitter @eth_energy_blog.

Suggested citation: Kate, Lonergan. “Energy systems and insurance: a primer”, Energy Blog @ ETH Zurich, ETH Zurich, December 12, 2023, https://blogt.ethz.ch/energy/energy_system_and_insurance